NEPAL - FOREIGN INVESTMENT OPPORTUNITIES

Welcome to Foreign Investment Promotion Division Home Page

FOREIGN INVESTMENT POLICY

ROLE OF FOREIGN INVESTMENT

Nepal has only recently opened the doors to foreign investment. The Foreign Investment and Technology Act (1981) as amended in 1992 lays down the law governing foreign investment and the applicable rules and regulations. The New Industrial Policy of 1992 identifies foreign investment promotion as an important strategy in achieving the objectives of increasing industrial production to meet the basic needs of the people, create maximum employment opportunities and pave the way for the improvement in the balance of payments. Foreign investment is expected to supplement domestic private investment through foreign capital flows, transfer of technology, improvement in management skills and productivity and providing access to international markets. In this context HMG is encouraging foreign investments in Nepal by providing attractive incentives and facilities within a liberal and open policy. The importance attached to foreign investment is clearly reflected in the New Constitution adopted by Nepal in 1991. In

the directive principles of the Constitution it is stated that a policy of attracting foreign capital and technology shall be adopted.

Nepal has only recently opened the doors to foreign investment. The Foreign Investment and Technology Act (1981) as amended in 1992 lays down the law governing foreign investment and the applicable rules and regulations. The New Industrial Policy of 1992 identifies foreign investment promotion as an important strategy in achieving the objectives of increasing industrial production to meet the basic needs of the people, create maximum employment opportunities and pave the way for the improvement in the balance of payments. Foreign investment is expected to supplement domestic private investment through foreign capital flows, transfer of technology, improvement in management skills and productivity and providing access to international markets. In this context HMG is encouraging foreign investments in Nepal by providing attractive incentives and facilities within a liberal and open policy. The importance attached to foreign investment is clearly reflected in the New Constitution adopted by Nepal in 1991. In

the directive principles of the Constitution it is stated that a policy of attracting foreign capital and technology shall be adopted.

FORMS OF FOREIGN INVESTMENT

Foreign investment are welcome in the form of foreign currency or capital assets. Reinvestment of earnings from foreign investments also constitutes foreign investment. In addition to this direct form of foreign investment, foreign loans, use of rights, specialisation, formulae processes and patent relating to technology of foreign origin, use of foreign owned trademarks and good will and use of foreign technical, consultancy, management and marketing services will also constitute foreign investment.

Foreign investment are welcome in the form of foreign currency or capital assets. Reinvestment of earnings from foreign investments also constitutes foreign investment. In addition to this direct form of foreign investment, foreign loans, use of rights, specialisation, formulae processes and patent relating to technology of foreign origin, use of foreign owned trademarks and good will and use of foreign technical, consultancy, management and marketing services will also constitute foreign investment.

AREAS OPEN FOR INVESTMENT

Foreign investment is welcome in Nepal in practically every sector of economic activity with the exception of the following:-

i. Defense industries which produce items like military armament, ammunition or explosive materials.

ii. Cigarettes and Bidi

iii. Alcohol.

JOINT VENTURES

Nepal encourages foreign investment as joint venture operations with Nepalese investors or as 100 percent foreign owned enterprises. Foreign investment are permitted upto 100 percent equity share holding in medium and large scale industries. A medium industry is defined as an industry with fixed capital investment between Rs. 10 million and Rs. 50 million. In large scale industries fixed capital investment will be in excess of Rs. 50 million. In cottage and small industries pemission may be granted to use foreign technology in the form of investment.

Nepal encourages foreign investment as joint venture operations with Nepalese investors or as 100 percent foreign owned enterprises. Foreign investment are permitted upto 100 percent equity share holding in medium and large scale industries. A medium industry is defined as an industry with fixed capital investment between Rs. 10 million and Rs. 50 million. In large scale industries fixed capital investment will be in excess of Rs. 50 million. In cottage and small industries pemission may be granted to use foreign technology in the form of investment.

CRITERIA FOR APPROVAL

In the granting of approval for foreign investment involving new investment, modernisation, diversification or expansion, the projects will be assessed taking into account the following criteria:-

- priority will be granted to investments in industry prescribed by HMG;

- financial and technical viability;

- contribution to employment generation;

- foreign exchange earnings or savings;

- competitiveness of products in international markets;

- appropriateness of technology;

- terms and conditions of investment and technology transfer;

- participation of Nepalese nationals in investment and management.

REPATRIATION AND DIVIDENDS AND CAPITAL

Foreign investors who have received permission to invest in convertible foreign currency are permitted to repatriate the folloeing outside Nepal at the prevailing rate of exchange:-

i. the amount received by sale of the whole or any part of the equity investment;

ii. the amount received as benefits or as dividends against foreign investments

iii. amounts received as payment of principle and interest on foreign loans.

iv. amount received under an agreement for the transfer of technology.

v. amount received as compensation for the acquisition of any property.

ROYALTIES, TECHNICAL SERVICE FEES AND MANAGEMENT FEES

Royalties, technical service fees and management fees may be allowed, as appropriate, on an evaluation of royalty agreements, technical service/management agreements.

FOREIGN TECHNICAL PERSONNEL

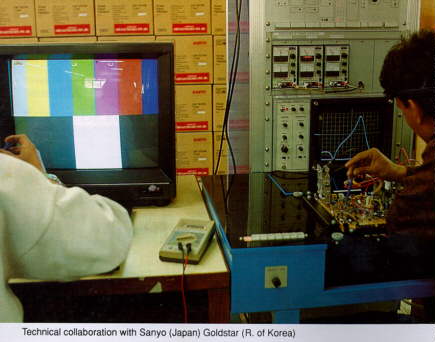

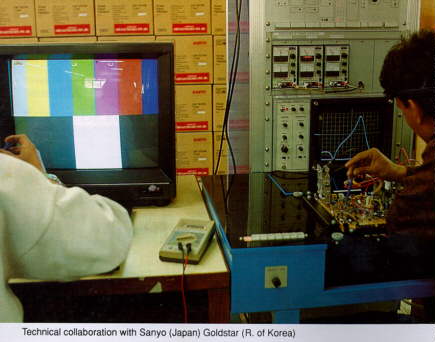

The employment of foreign technical personnel in projects is permitted with the approval of the Department of Labour. In such cases arrangements should be made to train counterpart staff in the technical/managerial operations within a time bound programme. Foreign experts working in Nepalese industries with prior approval, from countries where convertible currencies are in circulation, are permitted to remit upto 75 percent of their earnings in convertible currency.

The employment of foreign technical personnel in projects is permitted with the approval of the Department of Labour. In such cases arrangements should be made to train counterpart staff in the technical/managerial operations within a time bound programme. Foreign experts working in Nepalese industries with prior approval, from countries where convertible currencies are in circulation, are permitted to remit upto 75 percent of their earnings in convertible currency.

SECURITY OF INVESTMENT

Industries established under the Foreign Investment and Technology Act are assured of security of investments. They will not be nationalised.

INVESTMENT PROTECTION AGREEMENTS

Nepal has signed Investment Protection Agreements with France and the Federal Republic of Germany. Under these Agreements investments enjoy full protection and security. The Agreements also guarantee free transfer of payments such as capital, profits & loans. In the event of a dispute concerning an investment, provision exists for its settlement through arbitration under the International Centre for the Settlement of Investment Disputes.

ARBITRATION

If the foreign investor, the concerned industry and the Department of Industry fail to settle among themselves any dispute concerning foreign investment, it will be settled by arbitration rules of the United Nation Commission for International Trade Law (UNICTRAL). The place of arbitration will be Kathmandu.

If the foreign investor, the concerned industry and the Department of Industry fail to settle among themselves any dispute concerning foreign investment, it will be settled by arbitration rules of the United Nation Commission for International Trade Law (UNICTRAL). The place of arbitration will be Kathmandu.

DOUBLE TAXATION AGREEMENTS

In order to avoid the double taxation on incomes of foreign investors the Government will take necessary action to conclude agreements for the avoidance of double taxation with the countries of the concerned foreign investors. At present an agreement for the avoidance of double taxation has been concluded with India.

INCENTIVES AND FACILITIES

Foreign investments are eligible to receive the following incentives and facilities:-

i. Income received from exports is free from income tax.

ii. Income tax is exempt for a period of 5 years from the date of commercial production in the case of production oriented industry (other than cigarettes, bidi and alcohol) energy based industry, agro-industry, forestry industry, (other than saw mills and catechu) and mineral exploration industry.

iii. Income tax is exempt for a period of 7 years in the case of national priority industries.

iv. Specified industries, as fore example tourist, service and construction industries, are eligible for exemption from income tax for a period of 5 years on the recommendation of the Industrial Promotion Board and upon publication in the Nepal Gazette.

v. Industries are entitled to a reduction in tax rate on each income tax slab by 5 percentage points.

vi. Industries established in remote, under developed and less developed areas, other than cigarette, bidi, and alcohol industries, are entitled to an additional tax exemption of 50 percent, 20 percent and 10 percent; and in respect of excise duty, 25 percent, 15 percent and 10 percent, respectively.

vii. Industries are entitled to deduct one-third of the value of the fixed assets investment as depreciation allowed under income tax law.

viii. Industries established as Public Limited Cos. eith a minimum of 15 percent of shares distributed to more than 100 persons are entitled to a 5 percent reduction in corporate income tax.

ix. Industries in operation which diversify production through re-investments or expand installed capacity by 25 percent or more or modernise technology or develop ancilliary industries either in the same industries or in other industries are entitled to set off 40 percent of the value of the new fixed investment in computing taxable income. Such definitions may be made in one year or in instalments within a maximum period of three years.

x. Industries which invest in modern plant , machinery and equipment which will control environmental pollution are entitled to deduct 50 percent of the investment so made as deductible expenses in computing taxable income.

xi. Pre-operating expenses incurred in connection with skill development and training will be allowed to be capitalized.

xii. 10 percent of the gross profit is allowed as a deduction against net income on account of expenses connected with technologyor product development and skill enhancement.

xii. 10 percent of the gross profit is allowed as a deduction against net income on account of expenses connected with technologyor product development and skill enhancement.

xiii. Dividends declared from investments made in industry are exempt from income tax.

xiv. 5 percent of the gross income would be allowed as a deduction in computing net income on account of donation made for the improvement of schools, colleges, universities, private hospitals, religious places and other social welfare activities.

xv. 5 percent of the gross income will be allowed as a deduction in computing net income as expenses on account of expenditure incurred on advertisements for the promotion of products or services and for miscellaneous expenses.

xvi. Industries (other than cigarette, bidi, alcohol, saw mill and catechu) using 90 percent or more domestic raw materials in production, shall be entitled to 2 years tax exemption in addition to the tax exemption provided for production oriented, energy based, forest based and mineral exploration industries. This concession shall not apply to industries specified as national priority industries.

xvii. Industries which provide direct employment to 1000 persons or more shall be entitled to an additional 2 year exemption from income tax.

xviii. Interest income earned by a non-resident on a foreign loan will be taxed at a concessionary rate of 15 percent. Similarly royalties, technical and management fees earned by a non-resident person will be taxed at 15 percent.

xix. No Premium, customs duty, excise, sales tax and local tax will be imposed on raw materials to be used by industries established in the export processing zone or by any industry permitted to operate bonded warehouse facilities which export cent percent of their products.

xx. Export oriented industries receiving duty drawback facilities uner the Industrial Enterprises Act and industries manufacturing intermediate goods to be used for the production of exportable commodities will be refunded the amount of premium, customs duty, excise and sales tax paid on the raw materials used to produce such intermediate goods, as well as the excise and sale tax paid on such intermediate goods on the basis of the actual volume of the expert of the commodities manufactured by using them. For this purpose transferable tax credit system will be used.

xxi. Priority will be given to arrange infrastructures required for the establishment of industries.

xxii. Industries will be given priority for Government land and land in Industrial Districts for the establishment of Industries.

|Main| |Next|

Email

HMG

Ministry of Industry

Foreign Investment Promotion Division

Singha Durbar

Kathmandu, Nepal

Tel: 216692

Fax: 220319

Tlx: 2610MOI NP

Copyright 1996 by Foreign Investment Promotion Division, Ministry of Industry, HMG

Webmaster: Anita Shrestha, AMAA, INC

Nepal has only recently opened the doors to foreign investment. The Foreign Investment and Technology Act (1981) as amended in 1992 lays down the law governing foreign investment and the applicable rules and regulations. The New Industrial Policy of 1992 identifies foreign investment promotion as an important strategy in achieving the objectives of increasing industrial production to meet the basic needs of the people, create maximum employment opportunities and pave the way for the improvement in the balance of payments. Foreign investment is expected to supplement domestic private investment through foreign capital flows, transfer of technology, improvement in management skills and productivity and providing access to international markets. In this context HMG is encouraging foreign investments in Nepal by providing attractive incentives and facilities within a liberal and open policy. The importance attached to foreign investment is clearly reflected in the New Constitution adopted by Nepal in 1991. In

the directive principles of the Constitution it is stated that a policy of attracting foreign capital and technology shall be adopted.

Nepal has only recently opened the doors to foreign investment. The Foreign Investment and Technology Act (1981) as amended in 1992 lays down the law governing foreign investment and the applicable rules and regulations. The New Industrial Policy of 1992 identifies foreign investment promotion as an important strategy in achieving the objectives of increasing industrial production to meet the basic needs of the people, create maximum employment opportunities and pave the way for the improvement in the balance of payments. Foreign investment is expected to supplement domestic private investment through foreign capital flows, transfer of technology, improvement in management skills and productivity and providing access to international markets. In this context HMG is encouraging foreign investments in Nepal by providing attractive incentives and facilities within a liberal and open policy. The importance attached to foreign investment is clearly reflected in the New Constitution adopted by Nepal in 1991. In

the directive principles of the Constitution it is stated that a policy of attracting foreign capital and technology shall be adopted. Foreign investment are welcome in the form of foreign currency or capital assets. Reinvestment of earnings from foreign investments also constitutes foreign investment. In addition to this direct form of foreign investment, foreign loans, use of rights, specialisation, formulae processes and patent relating to technology of foreign origin, use of foreign owned trademarks and good will and use of foreign technical, consultancy, management and marketing services will also constitute foreign investment.

Foreign investment are welcome in the form of foreign currency or capital assets. Reinvestment of earnings from foreign investments also constitutes foreign investment. In addition to this direct form of foreign investment, foreign loans, use of rights, specialisation, formulae processes and patent relating to technology of foreign origin, use of foreign owned trademarks and good will and use of foreign technical, consultancy, management and marketing services will also constitute foreign investment. Nepal encourages foreign investment as joint venture operations with Nepalese investors or as 100 percent foreign owned enterprises. Foreign investment are permitted upto 100 percent equity share holding in medium and large scale industries. A medium industry is defined as an industry with fixed capital investment between Rs. 10 million and Rs. 50 million. In large scale industries fixed capital investment will be in excess of Rs. 50 million. In cottage and small industries pemission may be granted to use foreign technology in the form of investment.

Nepal encourages foreign investment as joint venture operations with Nepalese investors or as 100 percent foreign owned enterprises. Foreign investment are permitted upto 100 percent equity share holding in medium and large scale industries. A medium industry is defined as an industry with fixed capital investment between Rs. 10 million and Rs. 50 million. In large scale industries fixed capital investment will be in excess of Rs. 50 million. In cottage and small industries pemission may be granted to use foreign technology in the form of investment. The employment of foreign technical personnel in projects is permitted with the approval of the Department of Labour. In such cases arrangements should be made to train counterpart staff in the technical/managerial operations within a time bound programme. Foreign experts working in Nepalese industries with prior approval, from countries where convertible currencies are in circulation, are permitted to remit upto 75 percent of their earnings in convertible currency.

The employment of foreign technical personnel in projects is permitted with the approval of the Department of Labour. In such cases arrangements should be made to train counterpart staff in the technical/managerial operations within a time bound programme. Foreign experts working in Nepalese industries with prior approval, from countries where convertible currencies are in circulation, are permitted to remit upto 75 percent of their earnings in convertible currency. If the foreign investor, the concerned industry and the Department of Industry fail to settle among themselves any dispute concerning foreign investment, it will be settled by arbitration rules of the United Nation Commission for International Trade Law (UNICTRAL). The place of arbitration will be Kathmandu.

If the foreign investor, the concerned industry and the Department of Industry fail to settle among themselves any dispute concerning foreign investment, it will be settled by arbitration rules of the United Nation Commission for International Trade Law (UNICTRAL). The place of arbitration will be Kathmandu. xii. 10 percent of the gross profit is allowed as a deduction against net income on account of expenses connected with technologyor product development and skill enhancement.

xii. 10 percent of the gross profit is allowed as a deduction against net income on account of expenses connected with technologyor product development and skill enhancement.